The Bank of England (BoE) cut interest rates by 0.25% last month, marking the first rate cut in four years. Widely welcomed by the London housing market, this move has led to a rebound in property prices as Halifax reported a 1.5% year-on-year (YoY) increase in house prices across the UK capital in August. Although the annual change in the national average is 4.3%, average property prices in London (£536,056) are almost double the rest of the country (£292,505), making it an attractive time for buyers and sellers to cash in on the favourable market conditions.

Making hay while the sun shines

The rate cut was announced early in August, but house prices have been on the up since the start of summer. According to data published by the Office of National Statistics (ONS), prices in the capital increased for the first time in a year this May, growing by 0.2% after a 3.6% contraction in the 12 months to April and have been increasing steadily since then with July recording a 0.9% increase. The positive change occurred despite the higher cost of borrowing as inflation pressures eased to the BoE’s target of 2% in June, and the pound hit a one-year high against the dollar in July. Meanwhile, Britain’s economy witnessed its fastest growth in nearly three years during Q1 2024.

Sales enquiries are on the rise

At Benham & Reeves, we are already seeing the positive news usher in a new wave of enquiries from potential buyers and sellers looking to make the most of the busy September month. The growing interest shown by potential buyers is mirrored in data published by Rightmove, where the number of potential buyers approaching estate agents was up by 19% YoY in August compared to the 11% YoY increase in July. The enthusiasm of buyers is reflected in the number of sales agreed, which is now 16% more than a year ago when mortgage rates were peaking. The number of sellers has also witnessed a 5% uptick compared to a year ago.

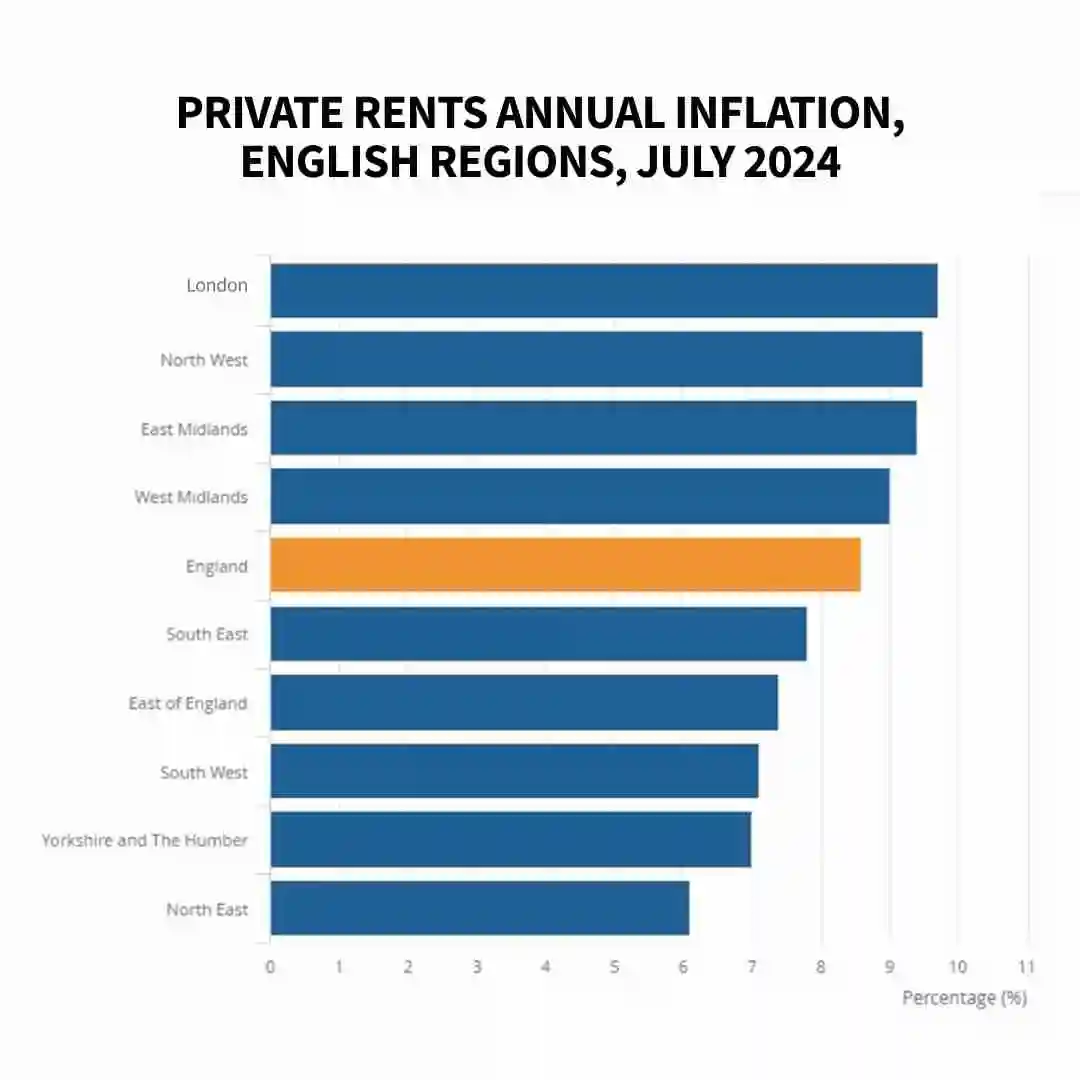

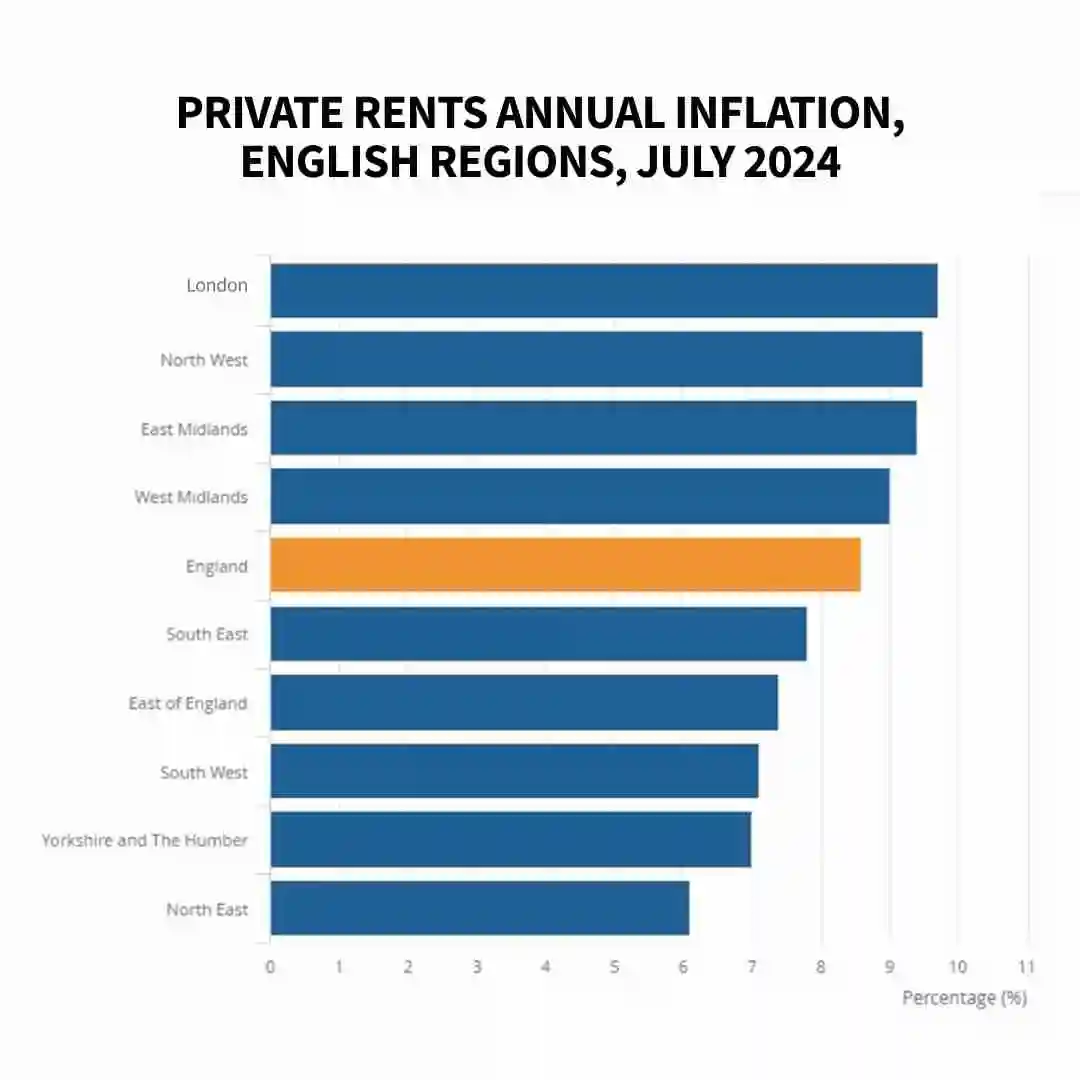

London records the highest increase in rents

According to the ONS, London is not just the region with the highest rent inflation in the UK but also commands the highest rent in the country. At £2,114, the average monthly rent in London is almost double that of Great Britain, which stood at £1,279 in July this year. Similarly, with a 9.7% YoY rental inflation in July 2024, the UK capital stood out as the best-performing English region for landlords and investors. Within London, the Royal Borough of Kensington and Chelsea recorded the highest rental average at £3,411.

The road to resilience and recovery

If the first half of 2024 was a story of resilience for the London property market, we can expect a recovery in the second half, as financial experts expect another rate cut before the end of 2024. The country’s biggest lenders, including Halifax, Nationwide and Barclays have also cut the cost of borrowing, which is now hovering around the 4% to 4.5% mark for five-year deals with a 25% deposit. For home buyers with bigger deposits of up to 40%, interest rates are starting to dip further as NatWest (3.77%), HSBC (3.84%) and Nationwide (3.94%) bring down rates to under 4% on their five-year fixed rate for home purchase.

However, rate cuts are not the only silver lining for the London property market, as rental demand continues to soar. Our 21 branches across the UK capital now receive over double the enquiries for each available rental property compared to what they received five years ago. The demand from international students enrolling in London universities and overseas corporate relocations has kept us busy, with our Japan Desk working tirelessly to find homes for well-paying corporate tenants.

Whether you are a buyer, seller or landlord looking to capitalise on the expected recovery of the London property market, get in touch with us at the earliest and we can help you secure the best deal out there.

International offices