- Selling

- Buying

- Landlords

- B&R Landlord hub

- Management services

- Vacant management

- Landlord reviews

- Rental investment

- Furnishing and refurbishment

- Yield calculator

- Free online valuation

- Stamp duty calculator

- ROI calculator

- Landlord resources

- EPC guide

- Video hub

- Area guides

- Fees for landlord

- Lettings Laws

- Why choose Benham and Reeves

- Renting

- New homes

- House prices

- International services

International offices

China, Hong Kong SAR, India, Indonesia, Malaysia, Middle East, Pakistan, Qatar, Singapore, South Africa, Thailand and Turkey

Learn more - Contact

- News

- Contact

- About us

- My B&R

How do you buy a UK property off-plan?

- Advice clinic

- 11.07.25

- Benham and Reeves

Investors and first-time buyers like off-plan homes that are still being built or planned because they can get a better deal than homes that are already built or ready to move into. According to sales data, about 31% of the homes sold in the UK last year were off-plan. In London, where apartments make up …

Dos and don’ts for first-time London home buyers

- Advice clinic

- 24.06.25

- Philip Lingard

Buying your first home in London is an exciting time. However, as a first-time buyer, mistakes like overshooting your budget by not factoring in the additional costs of property purchases or rushing with the due diligence process can prove expensive in the near and long term. To avoid the common mistakes many first-time buyers make …

Continue reading “Dos and don’ts for first-time London home buyers”

Should you buy property in a limited company? Pros and cons for London investors

- Advice clinic, Rental market update

- 18.06.25

- Vidhur Mehra

Since the implementation of Section 24 of the Finance Act 2015 in February 2016, the number of properties registered and held in a buy-to-let (BTL) companies has increased significantly. According to a recent report, BTL companies in the UK have more than quadrupled in the last nine years, from just under 93,000 in Q1 2016 …

Continue reading “Should you buy property in a limited company? Pros and cons for London investors”

What documents do you need to sell a property in London?

- Advice clinic

- 13.06.25

- Benham and Reeves

When selling a home in London, a seller must disclose certain information to the buyer, including title deeds, EPC certificates, planning permissions, and other relevant paperwork. Let’s look at all the documents required to sell a London property. 1. Title deeds In the UK, title deeds are essential records that prove legitimate property ownership throughout …

Continue reading “What documents do you need to sell a property in London?”

Sign up to our newsletter

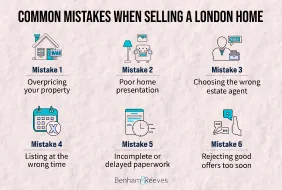

SubscribeWhat are the common mistakes sellers make in selling London homes, and how can they avoid them?

- Advice clinic

- 11.06.25

- Benham and Reeves

Given its popularity and soaring demand, selling a home in London can be an opportunity to make real profits on an appreciating asset. However, sellers need to get two things right – the timing of the sale and an accurate valuation of their property. Here is where the real challenges arise, as many sellers make …

The best ways to structure your London property investments to minimise tax

- Advice clinic

- 28.05.25

- Vidhur Mehra

The buy-to-let (BTL) model for property investments is a huge source of revenue for millions of investors. Whether privately held or through a limited company, the English Housing Survey reported that almost 29% of all London homes are rented, significantly higher than the UK average of 17%. With every 1 in 3.5 homes in the …

Continue reading “The best ways to structure your London property investments to minimise tax”

Cash buyer vs mortgage buyer – Which one is suitable for you?

- Advice clinic

- 21.05.25

- Philip Lingard

Usually, a property purchase in the UK can be financed in two ways. You can either ask a bank or private lender for help to obtain a mortgage or buy it straight with the liquid funds in your account. Although your situation and financial strategy will guide you, there are certain advantages and disadvantages you …

Continue reading “Cash buyer vs mortgage buyer – Which one is suitable for you?”

What to check when buying a new-build home

- Advice clinic, London living

- 21.04.25

- Benham and Reeves

Buying a new-build home, whether to live in it or let it out, can be an exciting journey as there is plenty to look forward to. From freshly decorated interiors and brand-new appliances to high energy-efficient ratings, leading developers in London compete to provide homeowners and renters with the best features.

Do you have a media enquiry?

Email us nowHow Stamp Duty is changing in 2025

With the temporary relief for home purchases coming to an end soon, many are asking when is Stamp Duty changing. Stamp Duty Land Tax (SDLT) rates in the UK will change for all property completions starting 1st April 2025. However, these changes aren’t new or unprecedented. In fact, they are just a continuation of the …

New year, new home – Best home improvements to add value to your London property

With improved stock availability and further rate cuts expected this year, leading London property portals like Rightmove and Zoopla have predicted 2025 to be a buyer’s market.

Navigating the leasehold system in the UK – What buyers should know

- Advice clinic

- 20.01.25

- Benham and Reeves

Property buyers in London and across the UK (except Scotland) make an important decision when buying a new home.

A guide to buying property in London’s most historic neighbourhoods

- Advice clinic

- 06.12.24

- Benham and Reeves

London has a glorious past which shines through its architectural marvels spread across some of the most affluent and sought-after areas.